What is the Cooling period in SBI? If you have ever come across the term SBI Beneficiary then you should know what is the Cooling period in SBI Internet Banking. The cooling period in SBI is very helpful for the SBI Net Banking users for reducing fraud.

Read this article thoroughly to understand the actual meaning of the SBI cooling period

What is Cooling Period in SBI Yono/SBI Internet Banking?

The feature of the Cooling period in SBI Yono/SBI net banking provides safeguards for the user from fraud.

Imagine a situation where your SBI internet banking credentials (username, password, OTP, etc.) are stolen by some fraud. Then he/she gains access to your SBI net banking account and can transfer any amount of money to any other account.

If you observe any illegal/fraudulent activities during this Cooling Period you can approach your bank and de-active your INB account. SBI provides this feature in order to minimize fraud.

You can read more about the cooling period notification by RBI.

Table of Contents

SBI Beneficiary Cooling Period

As of June 15, 2021, the duration of the SBI new beneficiary cooling period is 4 days. There is a particular duration of the Cooling period of different Banks.

if you don’t have an idea about how to add intra-bank beneficiaries in SBI then read this article. I’ve explained there very well.

The SBI Beneficiary Cooling period is only for those beneficiaries who are approved by OTP. If you have added a new beneficiary and approved through OTP then a Cooling period of 4 days from the date of approval is activated.

During the cooling period (4 days) you can transfer an amount of ₹5,00,000 (5 Lakh) to a beneficiary. Once the Cooling period is over, you can transfer up to the full limit. The maximum limit for Intra and Inter-Bank beneficiaries in SBI is ₹10,00,000 (10 Lakh)

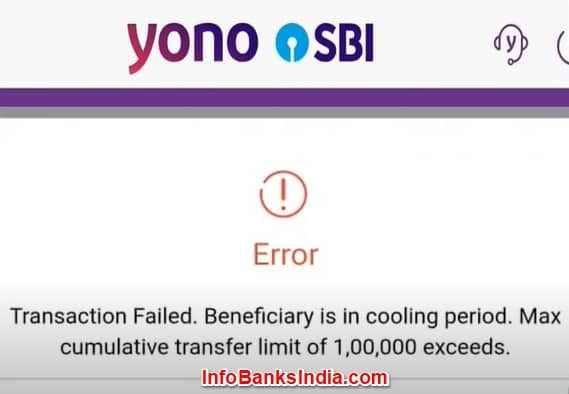

Transaction Failed Beneficiary is in cooling period SBI

You might have seen this above image like it is mentioning “Transaction Failed. Beneficiary is in cooling period. Max cumulative transfer limit of 100000 exceeds” in Yono App. This is due to the bank restriction. In banking terms, it is called the Cooling Period. The duration is only 4 days in SBI.

During these 4 days, you are allowed to transfer only ₹5,00,000 (5 lakh) or you can say only ₹1,00,000 (1 lakh) is allowed per day.

How to Remove Cooling Period in SBI?

Now, this is quite an interesting question on how to eliminate or remove the cooling period in SBI. Many a time you want to transfer money from with SBI beneficiary with Full limits. But this cooling period makes it difficult to make it possible.

Although there is no method to remove the cooling period in SBI, still you can eliminate the cooling period. Do you know the ways to approve any beneficiary in SBI internet banking? If not, here they are.

- Request to the Branch

- IRATA (Internet Banking Request Approval Through ATM)

- OTP

Out of these 3 ways, requests to the branch and the IRATA do not have any cooling period. So, use these first two methods in order to remove the cooling period in SBI.

Once your beneficiary gets approved/activated, you can avail the full transaction rights.

How to Approve using IRATA?

If you wish to approve your new beneficiary using IRATA then follow the simple steps as follows. It is one of the safest and most secure methods for instant approval.

To use the service of IRATA, you must have a 10-digit INB reference number.

- Visit your nearest SBI ATM.

- Swipe your card which is linked to your Internet banking account.

- Choose the option ‘Services’ and then choose the ‘Net Banking Request Activation’ option.

- Enter the 10-digit INB reference number.

This is how you can approve a new beneficiary using IRATA.

What is the SBI Beneficiary Activation Time?

According to SBI, if a beneficiary is added and approved by you during the period from 6 AM (IST) to 8 PM (IST) will be activated within 4 hours on the same day.

If you add a beneficiary beyond this period of time, then the beneficiary will be activated on the next day after 8 AM (IST).

Bonus Read: How To Pay School Fees Online SBI Collect

What is the SBI Beneficiary Transfer Limit?

You can set a transfer limit for individual beneficiaries. The maximum transfer limit is ₹10,00,000 (10 lakh).

Frequently Asked Questions

Can I delete a beneficiary during the cooling period in SBI?

No. SBI has restricted deletion of any beneficiary during the cooling period and the duration is 4 days. If you try to delete a beneficiary then it will display a message like”beneficiary cannot be deleted in cooling period as the beneficiary is added recently“. After 4 days, you can delete that beneficiary from the list.

Can we transfer money immediately after adding the beneficiary?

Yes, you can. But there are some prohibitions by SBI. Once, the beneficiary is added successfully, you can transfer a number of ₹1,00,000 per day. After 4 days (cooling period in SBI), you transfer an amount up to ₹10,00,000.

How can I transfer the maximum amount through SBI without adding a beneficiary?

SBI has a facility for transferring amounts from one account to another. You can choose SBI Quick pay to transfer ₹25,000 per day with ₹10,000 per transaction. Moreover, you can use the UPI-linked SBI account to transfer up to ₹1,00,000.

How much can I transfer after adding beneficiary SBI?

If you have added a beneficiary recently through OTP then you can transfer only up to ₹5,00,000 with ₹1,00,000 per day for 4 days, This is called the cooling period in SBI. Once the cooling period is over, you will get full transaction rights and can transfer up to ₹10,00,000/day.

Conclusion

I hope you have understood the meaning of the Cooling Period in SBI. If you want the full transaction limit as soon as the beneficiary is approved use the Bank visit and IRATA method and you can use OTP if you want the Cooling period to be applied.

John says

Login to your Internet Banking. Choose ‘Services’ ->’Others’ then choose ‘Internet Banking Request Approval’ option. Enter the 10-digit INB reference number and Confirm

Aswajith S says

How do we get the 10 digit INB number?