One of the main features of SBI net banking is fund transfer. This post will be a detailed guide on how to add Intra bank beneficiary for fund transfer in SBI.

Although there are many methods to transfer funds, adding an intra bank beneficiary is one of the easiest, and fund transfer is very easy.

What is Intra Bank Beneficiary Transfer

As the name suggests Intra bank fund transfer means fund transfer within the SBI bank accounts no other bank accounts. For example, person X who has an account in SBI transfers Rs 10,000 to Y who also has an account in SBI. It is not necessary that both the account holders have the same IFSC codes.

For all the State Bank of India Intra Bank transfers, you don’t need IFSC Code. All you need is the account holder’s name, account number, and transfer limit (Indian Rupee).

So, this will be a detailed guide on how to add Intra bank beneficiary for fund transfer in SBI.

Table of Contents

- What is Intra Bank Beneficiary Transfer

- How to Add & Manage Intra Bank Beneficiary for Fund Transfer in SBI

How to Add & Manage Intra Bank Beneficiary for Fund Transfer in SBI

To avail of the feature of How to Add Intra Bank Beneficiary for Fund Transfer in SBI, you must have access to SBI Net Banking. If you do not have an SBI Net Banking account then follow this tutorial to create an account/registration for SBI net banking.

How to Add Intra Bank Beneficiary in SBI Internet Banking

Follow the simple steps to add intra bank beneficiary in SBI through SBI net banking. It hardly takes 5 minutes to add an SBI beneficiary to your account.

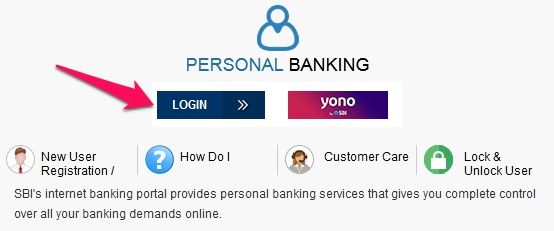

- Step 1: Visit the official SBI website https://onlinesbi.com

- Step 2: Click the LOGIN button in the Personal banking section.

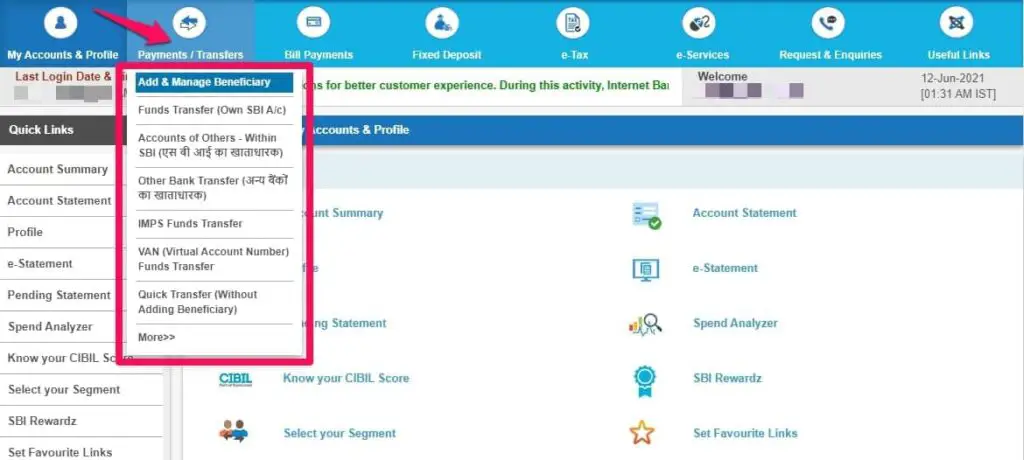

- Step 3: Now you are in the dashboard section of SBI Net banking. Hover over to the Payments/Transfers tab and click on “Add & Manage Beneficiary ” as shown in the image below.

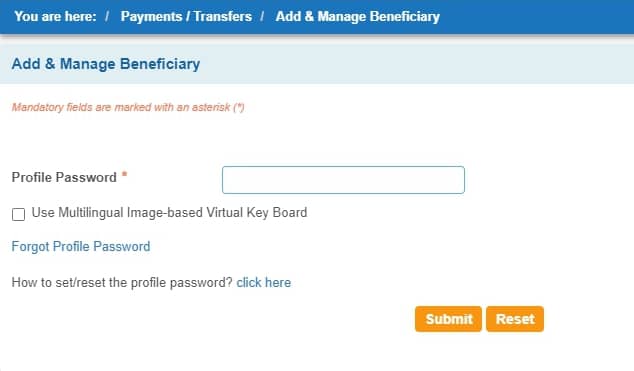

- Step 4: Now, you have to input your Profile Password of SBI net banking and click the Submit button.

How to Reset Profile Password for SBI Net Banking Online?

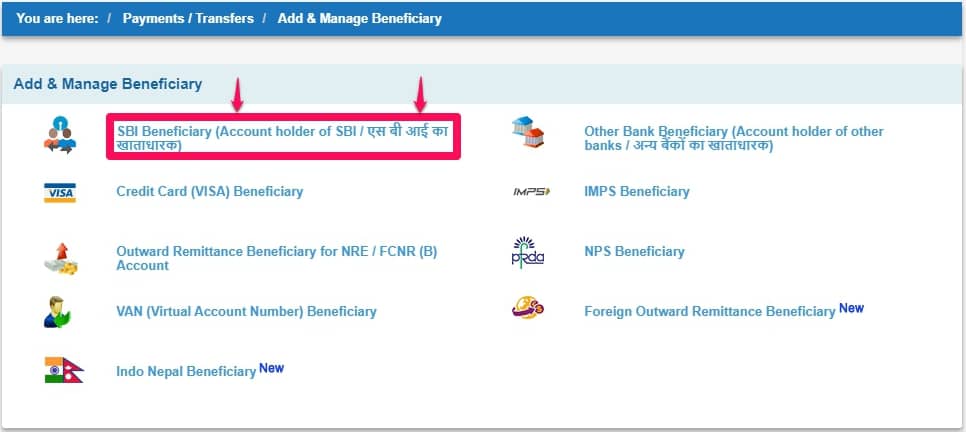

- Step 5: Here you will able to see multiple ways to add Add & Manage SBI Beneficiary. However, we’ll be discussing only how to Add Intra Bank Beneficiary for Fund Transfer in SBI.

Click the link SBI Beneficiary (Account holders of SBI)

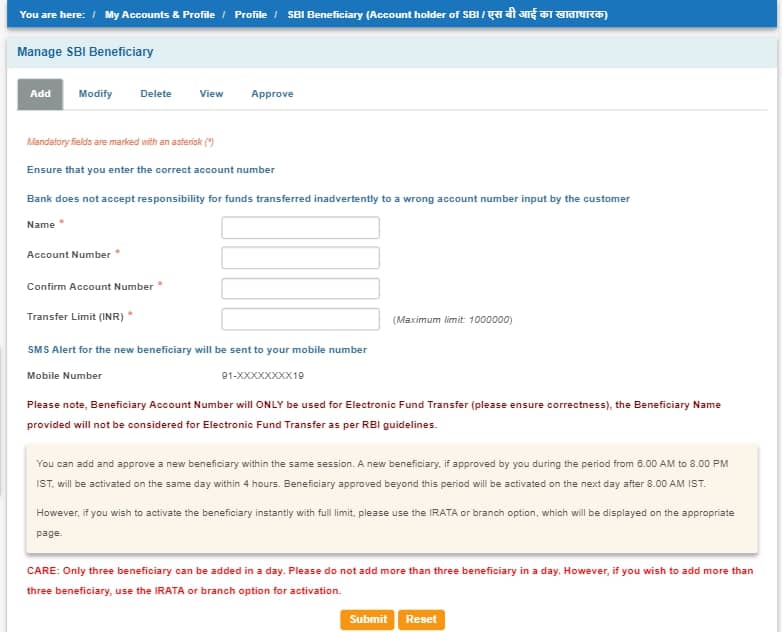

- Step 6: On this page, you need to enter the account holder’s name, account number, transfer limit (in INR), etc. Click the Submit button after filling in all the necessary details.

Upon successful beneficiary add you’ll get an SMS notification to your RMN (Registered Mobile Number)

SBI New Beneficiary Transfer Limit

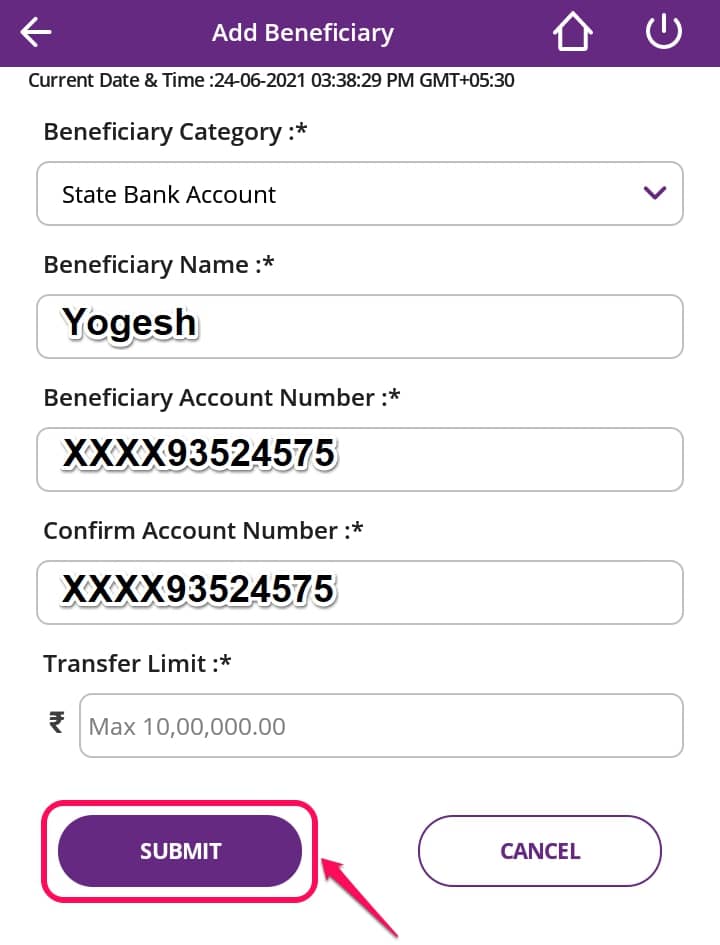

You can set a transfer limit for individual beneficiaries. The maximum transfer limit is Rs. 10,00,000 (10 lakh)

How to Modify Delete View and Approve SBI Beneficiary in SBI

Till here we have covered how to add Intra bank beneficiary for fund transfer in SBI.

Along with the Add and Manage Beneficiary, you can modify, delete, view, and approve any beneficiaries.

You can modify for the transfer limit for any beneficiaries, and delete any of them from the list. Also, you can view the list of beneficiaries that you added.

Moreover, you have the privilege to approve a beneficiary using any of the two methods:

- IRATA (Internet Banking Request Approval Through ATM)

- Bank Visit (Home Branch)

- OTP

What is the Beneficiary Addition Process?

State Bank of India: Only three beneficiaries can be added in a day. However, if you wish to add more than three beneficiaries, use IRATA or a Branch visit for activation.

Now you can add and approve up to three beneficiaries in each of the following categories and activate them within 4 hours by the system.

- Within SBI

- Outside SBI

- IMPS

- VISA

What is the SBI Beneficiary Activation Time?

SBI beneficiary activation time is faster than any other bank. You can add and approve a beneficiary within the same session.

However, SBI will verify the correctness of the beneficiary and during that time the beneficiary added by you will be pending.

According to SBI, if a beneficiary is added and approved by you during the period from 6 AM (IST) to 8 PM (IST) will be activated within 4 hours on the same day.

If you add a beneficiary beyond this period of time, then the beneficiary will be activated on the next day after 8 AM (IST)

Note: If you want to activate a beneficiary instantly with full limit, you can use either IRATA or Branch

How to Add Intra Bank Beneficiary in SBI through YONO Lite SBI

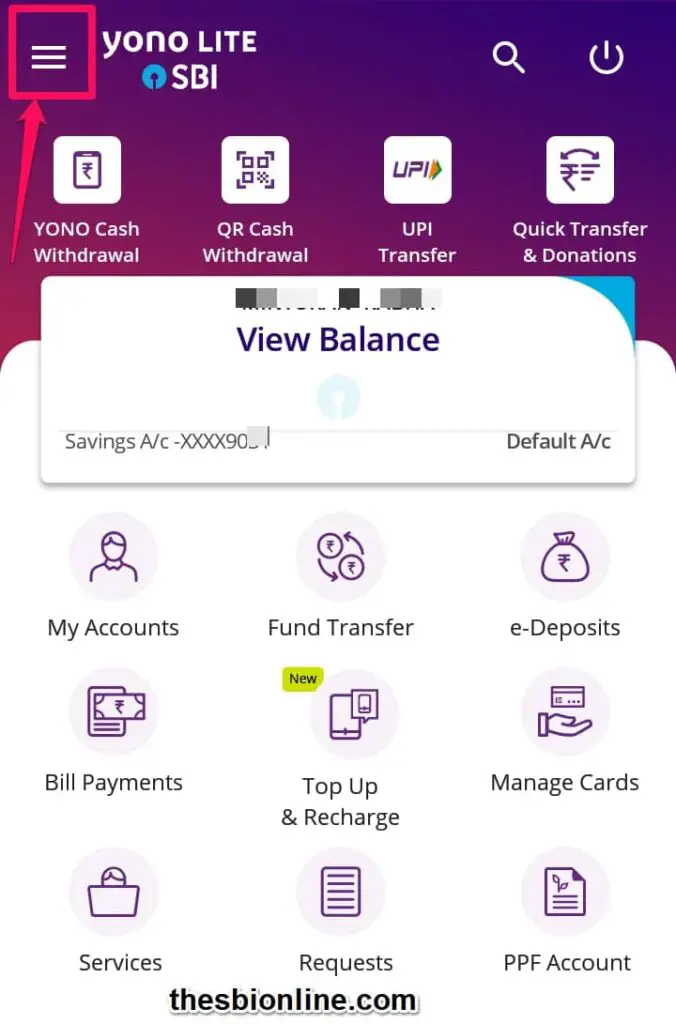

SBI customers now can add Intra bank beneficiaries for Fund Transfer in SBI using SBI YONO Lite mobile App. YONO Lite SBI is one of the official mobile apps of SBI. You can download it from the Google play store or directly from the link below.

Steps to add Intra Bank Beneficiary in SBI using YONO Lite SBI

- Log in with the SBI Internet Banking Username & Password.

- tap on the 3-dashed lines at the top left corner.

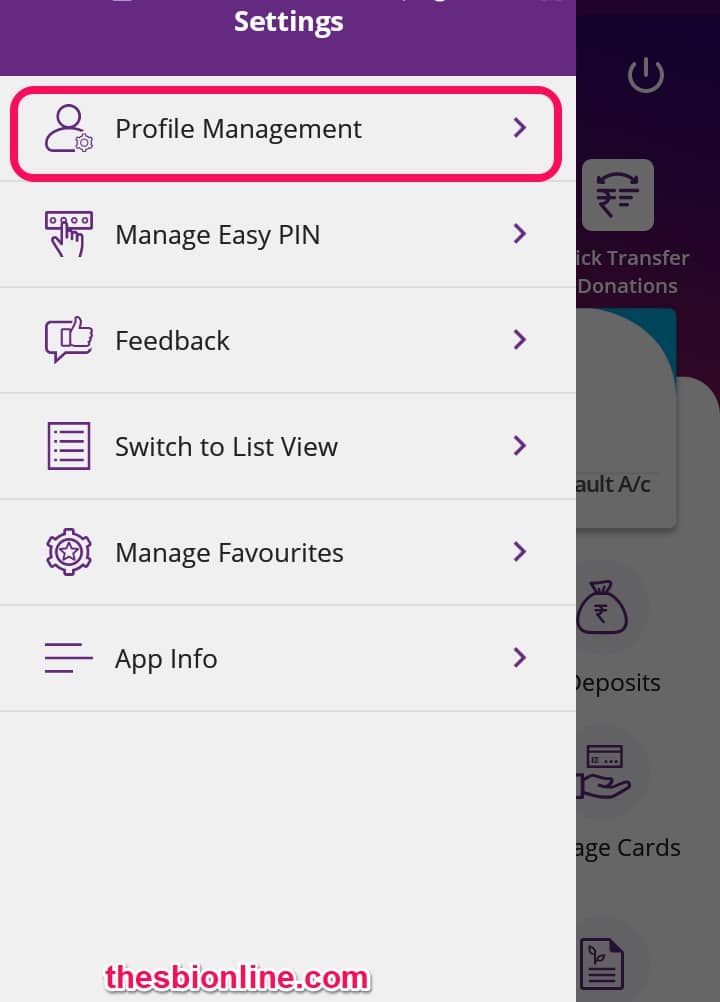

- Tap on the profile management.

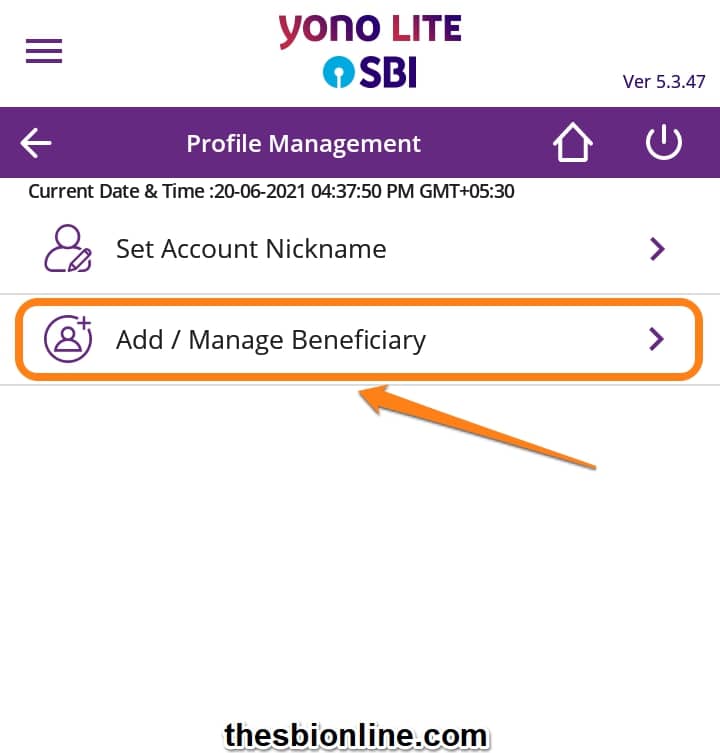

- Next, tap on “Add/Manage Beneficiary” and enter the Profile Password of SBI Internet Banking.

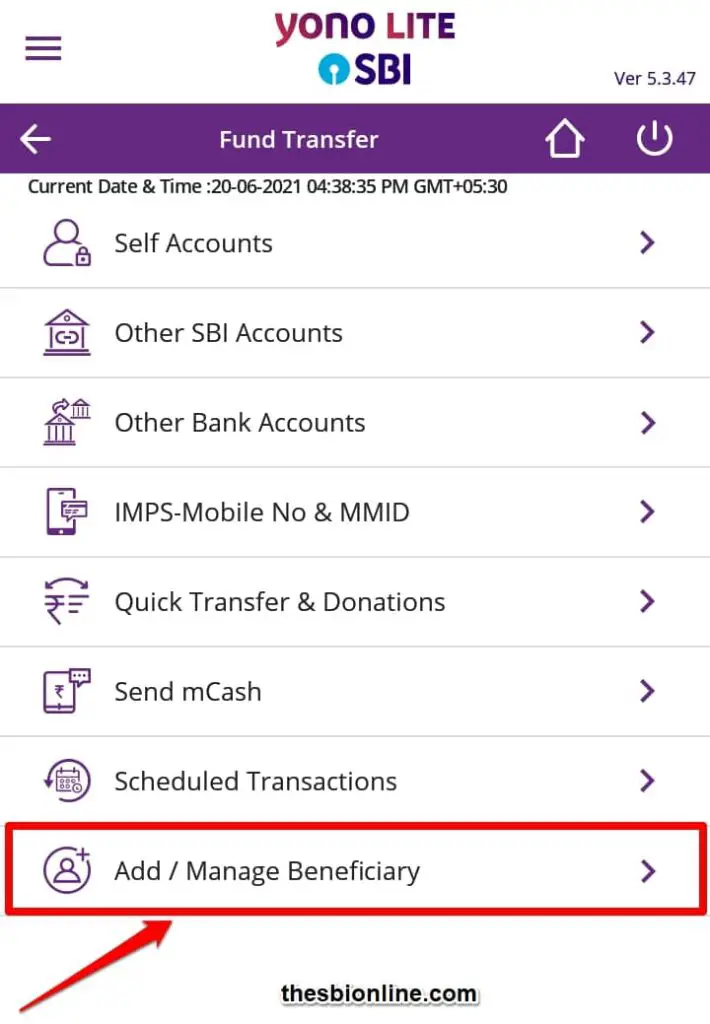

- For fund transfer, tap on Add/Manage beneficiary.

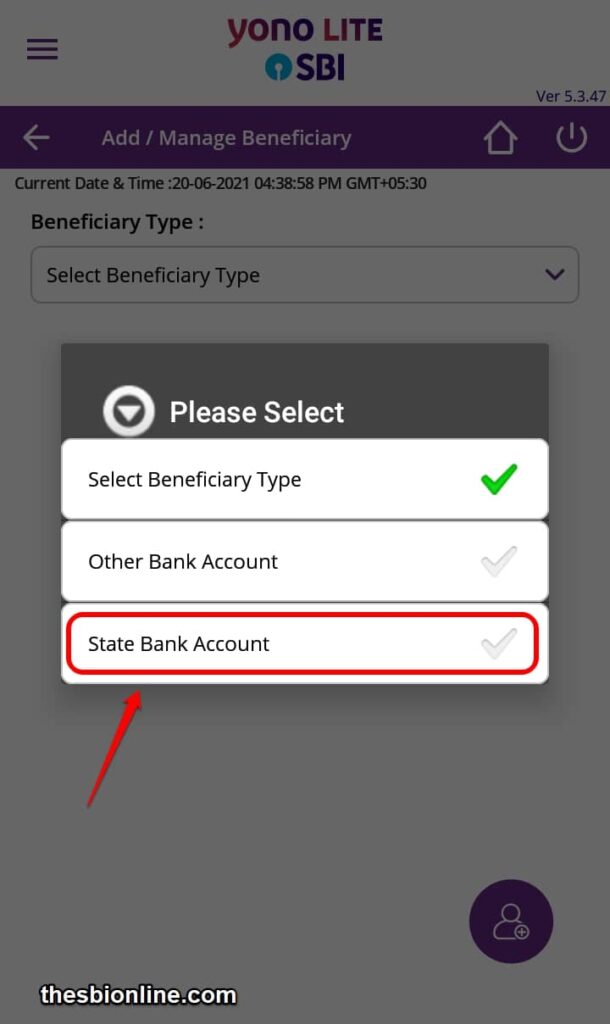

- Select State Bank Account to add Intra Bank Beneficiary for Fund Transfer in SBI

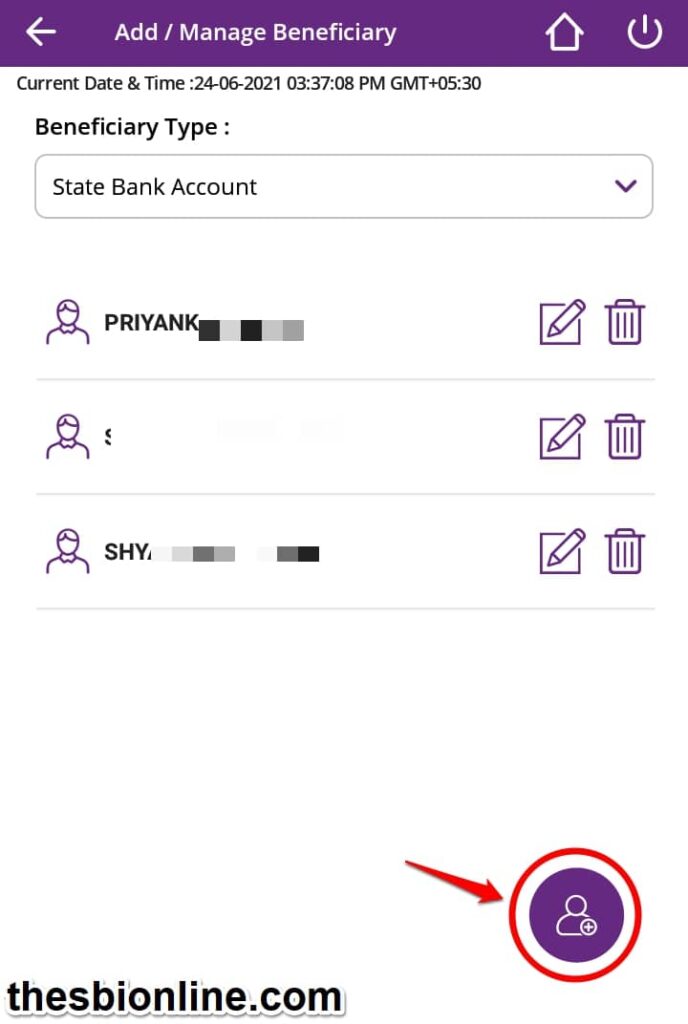

- Next, tap on the Rounded icon at the bottom to add intra bank beneficiary in YONO Lite SBI.

- Here, you need to enter the details of the SBI customer like beneficiary name, Beneficiary Account Number, and transfer Limit, etc.

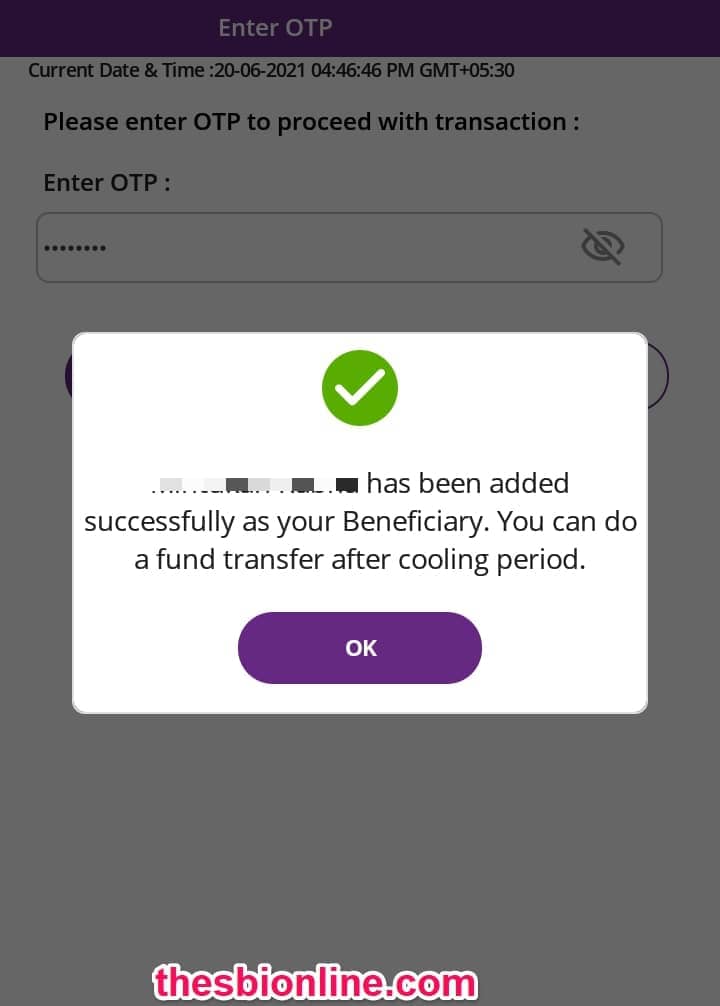

- Next, OTP will be sent to your registered mobile number. Enter the OTP digits and click the Submit button.

This is how you can add Intra Bank Beneficiary for Fund Transfer in SBI.

Frequently Asked Questions

Does RTGS work for Intra Bank?

Yes. Because both (accounts of the same Bank) those accounts are controlled by a single server managed by the bank, there is no involvement of any mediator.

How many beneficiaries can I add in SBI for Internet banking?

Maximum beneficiaries that can be added in a day through Retail Net Banking is 3 and through Corporate Net Banking is 10.

Why does it take time to add beneficiary?

It’s basically for customer’s safety. In case, someone gets access to your net banking account, he/she won’t be able to transfer money to any other account instantly.

For a funds transfer by RTGS in the same bank with different branches, is the IFSC code required or not?

Funds transfer within the same bank is not allowed to be routed thru NEFT/RTGS. Most Banks have a separate menu selection for transfer within the bank.

If both accounts are in the same bank, can we do an RTGS transfer online?

You don’t need to RTGS if both accounts are in same bank. Most banks now have core banking. If you have internet banking facility, all you need to do is add the other account holder as beneficiary. Once you transfer the funds, the other account will get credited immediately.

Final Verdict

Adding a new beneficiary in SBI retail and corporate banking is quite easy. However, if you find any problem while adding, deleting, viewing, and approving any beneficiaries do let us know in the comment section. If you really liked this post on how to add Intra bank beneficiary for fund transfer in SBI do share among your SBI account holders

Thanks for your blog post. I would to hear from you. This is one of the best posts regarding the adding of Intra bank beneficiary in SBI.